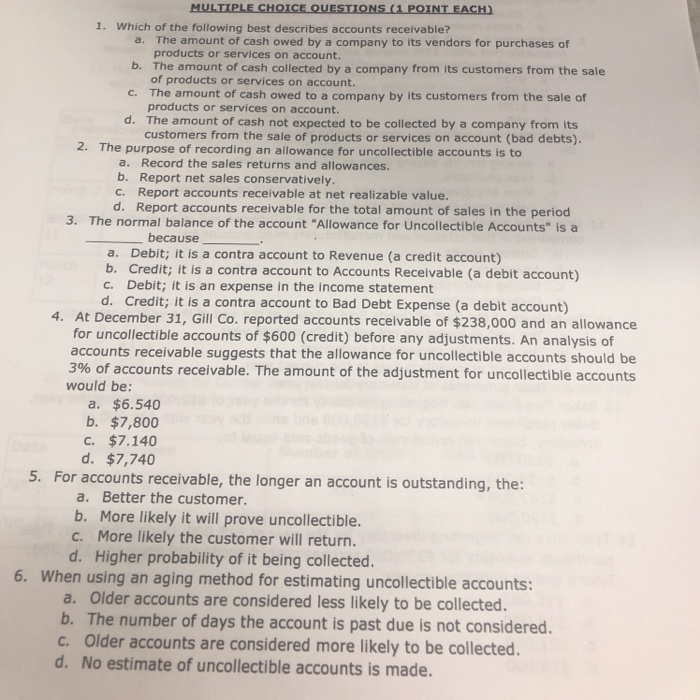

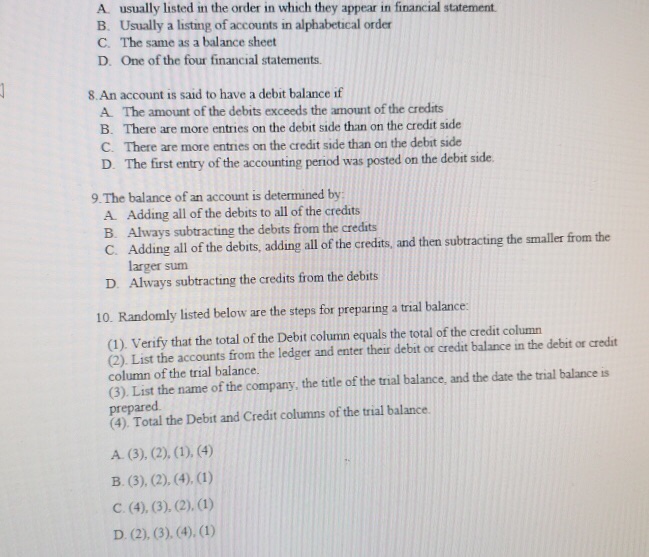

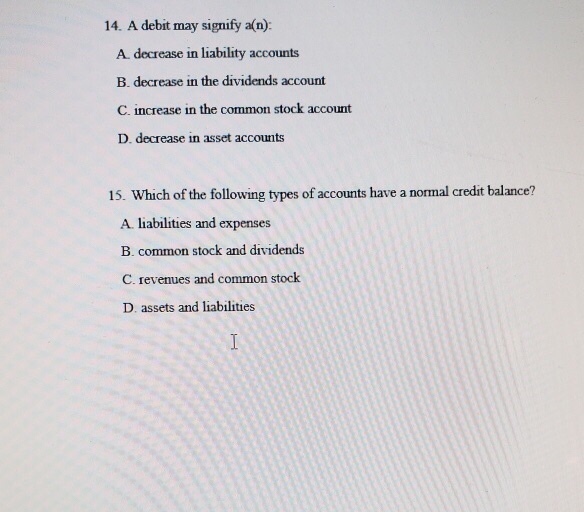

Which of the Following Best Describes Accounts Receivable

BAccounts receivable should be directly written off when the due date arrives and the customers have not paid the bill. Select one or more.

Solved Multiplechoice Ouestionslipointeachi 1 Which Of The Chegg Com

Check all that apply Multiple select question.

. AAn accurate estimate of bad debt expense may be arrived at by multiplying historical bad debt rates by the amount of credit sales made during a period. Which of the following best describes the proper presentation of accounts receivable in the financial statements. Control was surrendered by Signal.

When accounts receivable are confirmed at an interim date auditors need not be concerned with. They refer to revenues that are earned in a period but have not been received and are unrecorded. Which of the following best describes the proper presentation of accounts receivable in the financial statements.

Which of the following most accurately illustrates the effect of the increase in tax rate on the deferred tax accounts. Which of the following best describes the benefits to the borrower of selling asset backed securities. Which of the following describes accrued revenue.

Accounts Receivable in the asset section of the balance sheet and the Allowance for Doubtful Accounts in the. A profitability ratio that measures how quickly an organization generates revenue B. Accounts that have sent bad checks.

Insurance Expense would appear on which of the following financial statements. The tutor can help you get an A on your homework or ace your next test. What factors can cause a patient account balance to display a negative amount.

Accounts receivable is usually increased when accruing revenues. The normal balance of. B The borrower trades future cash.

Both It is an alphabetical or numerical listing of customer accounts and balances usually prepared at the end of the month and It is prepared from a list of customer accounts in. Adjustments involve increasing both an expense account and a liability account. Patients who do not pay in 30 days C.

Which of the following best describes accounts that occasionally go to an outside collection agency. A liquidity ratio that estimates how quickly an organization converts receivables to cash. The adjustment causes an increase in an asset account and an increase in a revenue account.

Which of the following statements best describes a positive request for confirmation of an accounts receivable balance. A a profitability ratio that measures how quickly an organization generates revenue B a liquidity ratio that estimates how quickly an organization converts receivables to cash C a liquidity ratio that measures how long it takes an organization to pay its bills D a profitability ratio that evaluates. Which of the following best describes a schedule of Accounts Receivable.

Thorne accepted the receivables subject to recourse for nonpayment. Conversely the shorter the bills hold days and the higher the clean claims submission the lower the accounts receivable days. Accounts Receivable in the asset section of the balance sheet and the Allowance for Doubtful Accounts in the expense.

They refer to earnings which have been earned but not yet billed. The customer will be asked to indicate to the auditor the current balance in the account. Select one or more.

These Multiple Choice Questions MCQs should be practiced to improve the Accounts Receivable skills required for various interviews campus interview walk-in interview company interview placement entrance exam and other. Accounts Receivable plus the Allowance for Doubtful Accounts in the asset section of the balance sheet. Which of the following best describes accounts receivable.

Accounts Receivable MCQs. Highly delinquent accounts D. The accounts receivables turnover ratio indicates how many times on average the process of selling to and collecting from customers occurs during the accounting period b.

Companies of similar size operating in the same country tend to have similar receivables turnover ratios c. Which of the following statements regarding the accounts receivables turnover ratio is true. Thorne assessed a fee of 2 and retains a.

Considering the necessity for some additional confirmations as of the balance sheet date if balances have increased materially. The adjustment causes an increase in an asset account and an increase in a revenue account. This section focuses on the Accounts Receivable.

The customer will be asked to respond to the confirmation request only if the balance indicated in the request is incorrect. When accounts receivable are confirmed at an interim date the auditors are not concerned with which of the following. Accounts Receivable plus the Allowance for Doubtful Accounts in the asset section of the balance sheet.

Accounts Receivable MCQ Questions Answers. The greater the bill hold days and the lower the percentage of clean claims the higher the accounts receivable days. Factored P750000 of accounts receivable to Thorne Company on December 3 year 2.

A Due to the portfolio effect the borrower can package up low quality accounts receivable and sell them for a premium price. Statement of Owners Equity. Which of the following best describes the concept of the aging method of receivables.

Which of the following best describes days in accounts receivable. A company has reported total deferred tax assets and liabilities amounting to 35000 and 50000 respectively in its balance sheet for the year ended 2012 In the fiscal year 2013 the statutory tax rate increased from 30 to 35. Accounts w a high accounts receivable ratio B.

Up to 20 cash back Which of the following best describes days in accounts receivable A.

Solved 1 Which Of The Following Best Describes Accounting Chegg Com

Solved 1 Which Of The Following Best Describes Accounting Chegg Com

No comments for "Which of the Following Best Describes Accounts Receivable"

Post a Comment